The global performance of the GPU market looks resilient as demand for eGSE and major expansion airport infrastructure projects open up opportunities for manufacturers particularly in the USA.

ITW GSE has started the year very strongly thanks to these projects turning into orders.

“We expect great things from some of our newest stars in our line-up, the 7400 eGPU series and the new 3500 PCA, which is produced in both Odense, Denmark and Palmetto, Florida,” said David Feuga, Global Sales Director.

Gary Walter, VP Sales and Marketing, from JBT AeroTech (supplying GPUs for more than 30 years), agrees the GPU market has held its own despite the impact of Covid on business over the past few years. “North America, in particular, remains strong as major commercial airline investment and government infrastructure funds continue to fuel growth in terminal upgrades andexpansions,” he said.

“We have seen similar rebounds in cargo operations. In these markets, there is a heightened effort toward carbon neutrality, for both commercial and governmental customers. Fundamentally, this means turning off the aircraft APU as quickly as possible during the aircraft turn.GPUs are an essential part of that objective.”

Dynell’s European GPU battery solution combined with redundant plug&play power module technology will certainly dominate the market over the next few years says Head of Sales and Marketing, Michael Brandstötter.

He shared that one of the biggest successes for the company has undoubtedly been the breakthrough in the US mobile GPU market.

“Major customers have placed orders and are experiencing Dynell’s new and innovative GPU technology. Another success was the cooperation agreement with Schiphol Airport and Zepp Solutions for the joint development of our upcoming hydrogen GPU as we believe that battery powered GPUs won’t be the only solution for the future,” he said.

For French manufacturer Guinault – the oldest GPU manufacturer in Europe supplying 400Hz mobile ground power units worldwide – it has seen a significant rise in activity all market segments: air conditioning, air start units and GPUs over the last year.

Lionel Clermont, CEO of Guinault, told GHI: “This growth is not surprising following two years of reduced activity during the Covid period with abnormally low investments by the airlines and handlers. According to Airbus, passenger traffic would rise in average by 3.6% per year from 2022-2040. GPU is a must have to ensure APU-OFF, together with air conditioning units in most airports.

Airlines have become more sensitive to environmentally sustainable operations, and to reducing their carbon footprint following

the pandemic. Therefore, we can expect a higher demand for these products.”

Yves Crespel, Alvest Group Communication Director, agreed, saying: “Globally, the GSE market is picking up and this certainly includes the GPU market as well. With a yearly market value of $350 million plus GPU sales have great growth opportunities ahead.”

Diesel or battery?

By 2030, the global GPU market is expected to grow with a CAGR of 4.7% from 2022 to 2030, and reach $798 million within this

forecast period, according to a report by ResearchAndMarkets. Demand for electric GSE and mobile GPUs is driving this growth as well as expansion airport projects – and the recovery in passenger travel.

However, in the market research report, it showed diesel-powered GPUs still dominate ramp operations in some parts of the world, especially in the Asia-Pacific region including India, whereas demand for eGPUs were more popular in North America and Europe.

Clermont, agrees with the report’s findings, saying: “Diesel-driven GPUs still represent the major market share but we are seeing some requirements for eGPUs in Europe and USA, but the lack of charging infrastructure appears to be a limiting factor. Guinault will continue to supply diesel and battery GPUs worldwide: a diesel GPU (together with a properly sized airconditioning

unit) reduces the APU carbon emission (as well as jet fuel consumption) by 95%. A battery GPU is better as it offsets the remaining 5% if the aircraft APU is off.

Our target at Guinault is to support the airlines and their handler to reach APUOFF operations, with an electrical solution if possible, otherwise we offer diesel.”

Dynell, which is currently undergoing significant growth, sees the greatest demand for eGPUs in Europe, followed by the US as well as certain countries in APAC.

Michael Brandstötter, Head of Sales and Marketing, explains: “I would argue that mobile GPUs (either diesel or battery) will always be on the ramp, as it is difficult for certain airports to supply remote stands with fixed power or generate enough power for battery GPUs to charge. This is currently a bit of an obstacle in the industry for eGPUs, as most airport infrastructures are not ready due to a lack of charging stations. This is contradictory as governments are pushing airports towards electrification.

“In addition, mobile units are assets that are decided on a much shorter term basis, while moving airports towards fixed power connections takes time to be developed and approved. Due to a lack of investment GPUS during Covid, many of these projects are

currently in the pipeline and will be carried out over the next few years,” adding that: “Dynell is growing very quickly, but we want to continue to focus on specific core markets and carefully evaluate each country to be able to provide a high level of aftersales support to our customers.”

TLD announced at last year’s GSE Expo that it would stop producing diesel GSE by the end of 2025. Crespel said: “The eGPU push in North America has ramped up faster than expected, showing demand for this type of equipment is clearly becoming popular. In APAC, I would set China apart where the push for eGSE is phenomenal, globally.”

Interestingly, ITW GSE decided to exit the diesel market altogether at the end of last year, and now plans to deliver its last diesel GPU in 2023.

“Our full focus going forward will be on environmentally sound solutions. This includes our line powered products, which is always preferable, and our battery powered line-up, whenever grid power isn’t readily available.

“The battery powered eGPUs are now fully accepted in the market. In Europe, major airports and airlines have truly adopted the zero-emission alternative to diesel. The US is also trending heavily in that direction with both airlines and airports being the first movers and major drivers of this transition. The mobile segment is also growing in Asia and MEA, although at a slower pace. We are seeing projects in key markets like Thailand, Japan, and Saudi Arabia, where the line powered fixed equipment remains our main driver for overall growth,” explained Feuga.

Making the affordability case

When GHI asked whether the affordability of eGSE was out of many operators reach, it prompted an electic response from the

market players.

Clermont said: “This will depend on the politics all over the world: some locations like California have been keen on switching

to zero (local) emission GSE. Diesel has always been a very cheap source of energy (3,3 kWh/€) despite its already high (45%)

tax content! In many countries, people especially the younger generation are more concerned by the air travel carbon footprint.

Laws, rules and government taxes might be necessary for a long-term paradigm shift, accelerated by society’s expectations.”

Brandstötter said: “I don’t see the trend toward eGSE as being so much related to the price level of fuel, but I’d rather say that the

argument for going green together with the reduction of CO2 footprint and maintenance (which is significantly higher for diesel units,

which also generates high noise levels on the apron) are the major reasons behind demand for eGSE.”

“I believe the shift is here to stay – more in some global regions than others. Better understanding and improved technology show that the actual cost of ownership and ROI has been proven to be at a smaller premium than prior eGSE trends, with quicker ROI, while providing improved reliability, reduced maintenance and simpler operations. The trend is here to stay,” said Crespel.

Feuga from ITW GSE puts it like this: “If any operator thinks they cannot afford eGSE, what they can’t afford is diesel. There are very few places where diesel is the economical choice, nowhere is it the environmental choice. ITW GSE was the first to introduce the eGPU and influence the aviation industry, and although we are only seeing a few other companies offering eGPUs, we believe that the green transition is an irreversible one. Not only because the fuel prices are still relatively high compared to before, but because eGSE has already changed the industry. And according to what we are currently seeing in the market, this transition will only accelerate from here.”

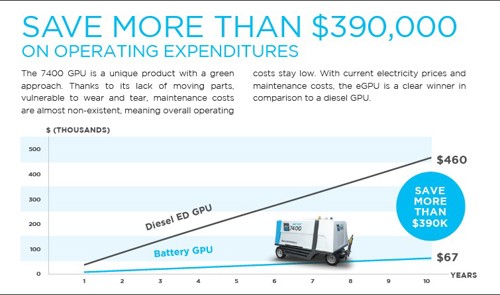

ITW GSE carried out a study to prove the huge cost-savings involved in using a 7400 eGPU compared to a diesel GPU.

Please see the graph below.

Overcoming infrastructure difficulties

Despite the long-term savings on operating costs of a eGPU, infrastructural constraints and lack of battery charging facilities still

remain a challenge at many airports across the world. TLD is aware of this conflict and part of its strategy is to assist those customers to overcome these barriers.

“We are fully developing our offer with fully electric or hybrid GSE that can adapt to existing infrastructure and allow to operate within existing constraints whilst being ready for the future,” said Crespel. “Today we offer a more extensive selection of GPUs than anyone on the market.”

Walters shared how JBT AeroTech is providing solutions as well. He said: “Charging GSE batteries remains a challenge. The costs of upgrading the power grid, running cables, construction work, trenching and the like are huge, especially at airports. As part of JBT’s solutions approach to carbon neutrality, we have developed and introduced AmpTek. Often, there is surplus GPUS power available at the gate, near the rotunda of the boarding bridge. The bridge and GPU have significant power available for their operations, but typically only use a fraction of that power during an aircraft turn and very little during overnight aircraft parking.

“JBT’s AmpTek taps into this unused power and smartly shares it with battery chargers. As a result, GSE batteries can be charged, near the gate (avoiding long drives to battery charging stations), without extensive power upgrades, cable runs, and construction projects. It is more cost-effective than ever to field a green, all-electric GSE fleet with AmpTek load sharing technologies.”

In addition to the hydrogen GPU, which will be launched at Schiphol Airport toward the end of this year, Dynell has noticed that the issue of a lack of power at many airports is not going away anytime soon.

“Hence, we have introduced our energy hub which comes along with various customised charging points for eGSE and acts as peak

shaving solution during the day when traffic is more congested and power not available,” explained Brandstötter.

EcoGate system

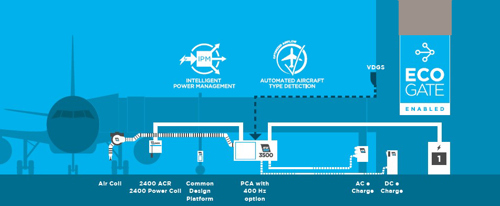

ITW GSE has taken an innovative approach to tackling power infrastructure constraints by creating a new system called the EcoGate. It works by integrating all units into a high efficiency system using Intelligent Power Management (IPM) technology. Hosted in the 3500 PCA, IPM continuously monitors how much power a GPU and other connected units require.

If the GPU experiences a sudden increase in demand from the aircraft, and the total power demand exceeds what is available, IPM temporarily “borrows” power from the PCA. There is no perceptible loss of comfort for passengers and crews, as these peak

requirements from the GPU will be brief.

“EcoGate enables airports to make improvements they could not make affordably before, because it eliminates the

biggest obstacle to progress – the need for expensive new infrastructure,” explained Feuga. “Together with the EcoGate system

approach, the 3500 PCA can unlock new possibilities at both existing and new gates, as it will allow airports and airlines to better

utilise existing capacity, by upgrading their gates without having to add additional power infrastructure.

“In many cases, we will actually be able to add a 3500 PCA 150 to a gate, where they only had a GPU installed previously. We can do this because of Intelligent Power Management, that lets the airport utilise the available power at the gate smarter. IPM monitors the power demand from the GPU and adjusts the 3500 PCAs consumption, to ensure that the complete power draw at the gate never exceeds the total available power.”

Other obstacles

High inflation and sourcing components remain challenging for businesses. Feuga said: “General inflation and increasing prices on components remain a challenge for any industrial company and it is challenging to pass on the higher pricing to the market. We are quickly getting back to the rapid delivery times the market knows us for.”

While delivery times can be a challenge with order backlogs exceeding 12 months, Guinault is planning to build a new manufacturing facility and a storage building in 2023 to increase its production capacity.

Clermont said: “The supply chain has become unpredictable as some component shortages still occur randomly. As a company, Guinault has become very integrated in terms of technology, so we can guard ourselves against supply chain shortages, as equivalent replacement components can be found and qualified if necessary, which is more difficult for general manufacturers.”

For Dynell, it says its biggest challenge is finding enough qualified people to welcome to the company. “We are located in an

industrial area where the lack of people is the biggest obstacle,” said Brandstötter.

“Fortunately, our ambitious employees in the supply chain department have already secured the supply of volatile components until 2026! We have concluded certain framework agreements for important components that ensure a stable supply chain. However, from time to time we are still affected by certain standard components that surprisingly cannot be delivered on time.”

Outlook

It’s reassuring for suppliers that the GPU market is rebounding strongly as the aviation sector bounces back from Covid, which as JBT AeroTech describes is closely linked to “a new imperative –carbon neutrality”.

“JBT AeroTech fixed and mobile ground power units and pre-conditioned air units used in connection with our fleet management iOPs telematics capabilities and AmpTek power sharing products make it easier than ever to go green for enhanced sustainability in the aviation sector,” said Walters.

The outlook for Dynell is more than positive, says Brandstötter. “We have doubled our sales compared to 2021 and will double them again in 2023. In fact, we have already approved our expansion plans and will add another production facility to our existing one. To ensure strong local support, we will also add one to two local offices in new countries to our footprint. In addition to the opportunity for growth, reducing our carbon footprint in production will play an important role, whether it is recirculating packaging with our suppliers or generating our own green energy. This strategy goes hand in hand with our solid-state converter technology which is the most efficient on the market and enables our customers to achieve significant energy and cost savings.”

Guinault is focusing on its APU-OFF strategy, offering all possible solutions to reach the goal: diesel, electric from grid, electric with batteries, fixed, mobile GPU/ACU/ASU. “We believe in such a complete offer and unique focus on APU-OFF will help the airlines to reach their goal whatever their preference,” said Clermont.

ITW GSE is continuing its strategy to exit the diesel engine market in 2023. “This will free up resources and capacity to meet our ambition to remain the number one GPU and PCA manufacturer in the industry. It will also mean that our only mobile GPU offering will be the 7400 series, which covers all aviation needs, from 28VDC to 90-180kVA 115V 400Hz,” said Feuga.

“We cannot think of a better time to be in the aviation industry.”